While neither software is flawlessly simple, Xero is probably easier to pick up if you have no idea – or inclination – how to get started with running a business payroll. If you’re still wavering on the fence about whether Sage or Xero is the best payroll software for your needs, take a look at the table below. Here, you’ll find a summary – and a star rating out of five – of all the critical factors likely to factor into your decision.

Sage Accounting Software

Payroll is just one of the many other products Sage offers as well. For example, if you’re also looking for an HR management solution, Sage HR integrates seamlessly so you can manage your workforce. There’s also a separate time-tracking software—Sage Timeslips—and even a customer management tool called Sage CRM. While it might be nice to have all of these in one dedicated software, it’s nice you can pick and choose exactly which components would best benefit your business. Neither software includes payroll—but you can add it on for a price.

Sage offers the Sage Intacct Support system and a peer community for customer service understanding progressive tax questions. Support is offered 24 hours per day from Monday to Friday. Customer service phone numbers are available for customers and partners only.

- Xero offers a rich knowledge base full of articles, videos, and online courses.

- It has been around since 1981 and is currently available in 23 different countries.

- Even in their starting plan, Sage gives you unlimited invoices and features like automatic bank reconciliation.

- Better is a subjective concept; what might be perfect for one company could fall painfully short of the mark for another.

Final verdict – is Sage or Xero best for your business?

Learn more about how we rate small-business accounting software. Wave offers basic accounting and invoicing tools for very small service-based businesses and solopreneurs. Offers two plans for small service-based operations and other microbusinesses with up to 10 general journal description entries example employees. While none of these software solutions offer free versions, Xero FreshBooks and Sage let users test out their products for 30 days, free of charge. Xero offers the strongest free trial, unlocking its full suite of features and 24/7 online support channels to users who sign up. We’re committed to making accurate verdicts at Tech.co, so when comparing accounting software our research team measures a number of metrics including ease of use, advanced features, and support tools.

For the price, Xero is a powerful tool that can help you manage everything from inventory to file storage. It also integrates with over a thousand apps, meaning if you can’t find a native feature you need, you can likely add it on. The included mobile app is great for checking accounting reports or invoices on the go.

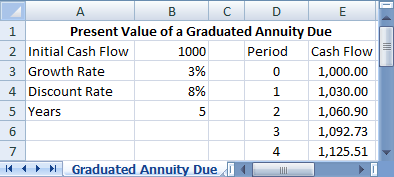

Advanced analytics for your business

It includes payroll, expenses, advanced analytics, project tracking, and even a mobile app. On the other hand, Xero’s accounting software offers a wider range of features, which makes it better for small business owners and medium-sized businesses. If you need more advanced tools, also look at Sage’s other products, Sage 50cloud and Sage Intacct. Inventory tracking can be a particularly useful feature of accounting software for product-based businesses.

Jump to our methodology section to learn more about our thorough and independent research process. Sage’s low-tier Accounting Start plan allows ordinary annuity definition for only one user. That makes it a stellar choice for smaller companies that don’t need multiple users accessing the accounting system.

Automatically sync everything from payments to customers, invoices, coupons, and much more. You can even create audit-ready reports when it’s time for the tax season. Where Sage excels is its lack of limits on clients and invoices. This can be great for freelancers doing a ton of business each month. One drawback is that the base plan only has support for one user. Automatic bank reconciliation makes sure your transactions are in sync, while the automated system converts quotes and estimates into sendable invoices.

لا تعليق